The ruckus over the Republican tax plan has already subsided after it was passed but it is unlikely to be forgotten soon. This year many Americans will be affected by the tax plan especially when the IRS provides employers fresh guidelines on the deductions they should be making from employee paychecks. The tax plan is expected to be a major point for discussion during the 2018 midterm elections which could be supplemented by regular tweets from the president speaking about higher stock prices and fresh employment opportunities.

The question which haunts the minds of the people is headed in a different direction because they are trying to understand whether the tax plan will also help to improve the economy. It would be difficult to answer the question with a simple yes or no and we are just making some guesses based on the information provided to us by the experts.

The Economists View Of The Tax Plan

An entire bunch of economists had been questioned about whether improvements could be seen in the economy after the tax plan was revealed. For some reason, the economists refrained from mentioning that the bill introduced could create economic growth during the long-term. 42 economists had been questioned about the tax plan and nearly 52% confirmed the tax plan wouldn’t lead to the desired level of economic growth. 2% agreed on the positive side and 36% were uncertain about their predictions.

The economists were not unanimous in their decision except for the fact that none of them were confident that substantial economic growth will be seen from the tax plan which has been introduced.

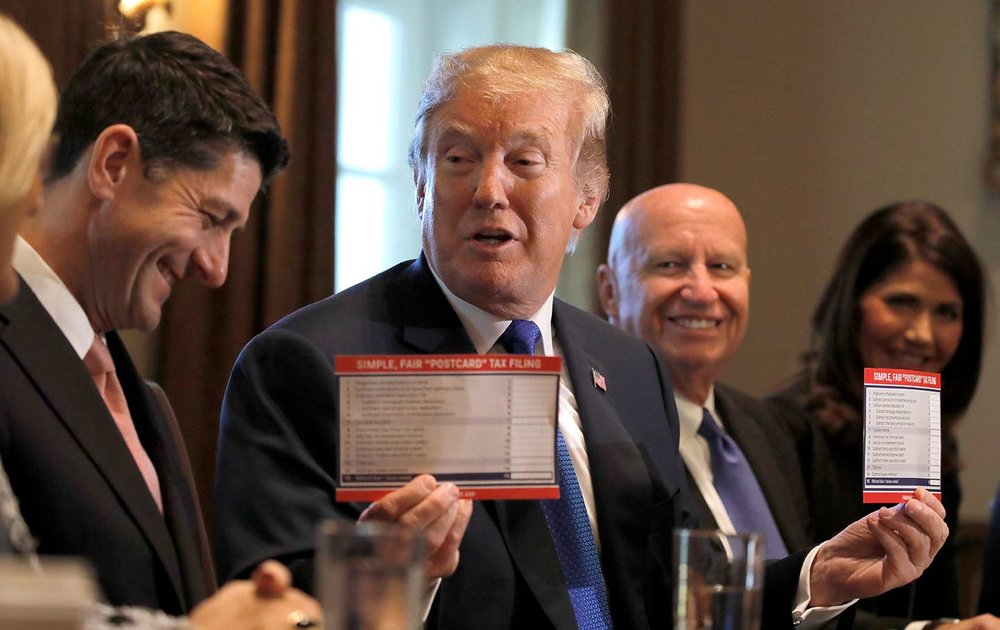

What Are The Republicans Commenting On the Tax Plan

The Republicans had a view which was in sharp contrast with that of the economists and believed that GDP could be boosted by 0.4% every year over the next decade. A number of expert analysis of the tax plan had agreed that shortfalls in the kind of growth predicted would definitely be seen. This leads us to look into some of the finer points of the tax plan which is expected to affect all.

The belief among the GOP that tax cuts can perhaps create growth is not a wrong assumption. They are depending on the simple premise that giving people or businesses some extra dollars via the tax code would encourage them to spend more and provide a boost the economy.

The different tax cuts which have been introduced over the years have affected the economy differently. The chief economist at Moody’s had estimated the effects of different policies in 2012. The report of the analytics revealed that the temporary child tax credit which was introduced in 2009 had boosted GDP by $1.38 against every dollar lost because of the tax cut. Looking at the growth figures of the past questions may be raised about whether this tax plan is possibly going to improve the economy. Experts believe that the growth may not be as high as expected though the costs are probably going to hit the roof. Experts are of opinion that the tax plan will probably create a temporary high before tapering off in two or three years. Stronger near-term growth is expected for the economy in 2018 and 2019 with the stimulus which has been created by long-term tax cuts which have been financed by the deficit. Temporary growth will be generated because of these cuts which will also result in higher interest rates.

The higher interest rates will result in any growth which is seen being be tapered off but it is unlikely that the feds will refrain from increasing the rates in an attempt to boost the economy. The interest rates are presently well below the pre-recession period but central bankers are strongly inching the rates to higher levels.

The stock markets are looking good and so is the job market even as GDP growth has looked to be on solid ground until recently despite not much room being available for improvement. The new demand in the economy is not expected to last unlike the initial burst and is therefore likely to fall.

Overall the tax plan is expected to be beneficial but at the same time, it is not expected to be a long-lasting one simply because the space for growth is just not available. People affected by the tax plan will do well to consider the overall condition of the US economy when looking at the tax plan introduced recently rather than worry only about growth because it could leave them disappointed in the years to come.