Steve Jobs once called Warren Buffett to talk money. Specifically, what to do with Apple’s growing mountain of cash. Buffett, famous for knowing how to grow money, gave a straight answer: buy back Apple stock. Jobs listened. Then chose not to act.

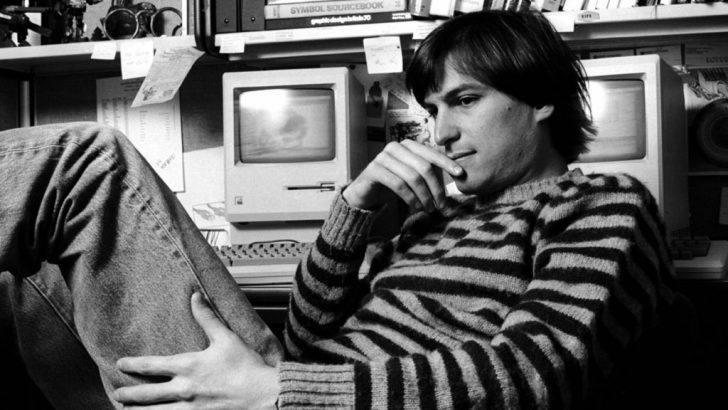

However, this wasn’t a random choice. It revealed something deeper about how Steve Jobs operated. He didn’t just lead Apple. He shaped it in his image. This moment, small on the surface, says a lot about how Jobs thought, moved, and trusted his instincts more than tradition.

Steve Jobs Wanted Control More Than Stock Gains

Steve Jobs didn’t ignore Warren Buffett’s advice because he thought it was bad. In fact, Jobs agreed with him. He also thought Apple stock was undervalued. At the time, in 2010, Apple shares were trading around $7.40. Today, they are worth over $245. Buffett pointed out that buying back shares would boost the value of existing ones – a smart move for shareholders. But Jobs didn’t bite.

Why? Because having cash meant having freedom. With billions on hand, Jobs had options. He could act quickly. He could fund ideas. He could protect the company in a crisis. Buying back stock meant locking up that flexibility. That wasn’t how Jobs liked to run things.

Holding on to that cash wasn’t a missed opportunity in his eyes. It was a war chest. One that let Apple move fast and stay bold, even when the market didn’t see it coming.

Steve Jobs Sought Advice But Always Did It His Way

Steve Jobs wasn’t closed off to outside opinions. He respected smart people. He admired Buffett’s investing genius. That’s why he called. He was curious. He listened. But that didn’t mean he would follow anyone’s lead. Even when advice made perfect sense, Jobs weighed it against his own gut feeling. In this case, his instincts won.

The Buffett conversation happened just a couple of years before Jobs passed away. Buffett shared that they talked through four main options: paying dividends, buying other companies, repurchasing shares, or just sitting on the cash.

Vision Over Convention

This moment with Buffett wasn’t just about money. It was about leadership style. Steve Jobs didn’t lead by the book. He wasn’t worried about keeping Wall Street happy every quarter. He played the long game. And that often meant ignoring conventional wisdom, even when it came from someone like Warren Buffett.

He hired only the best people and had no patience for mediocrity. He ran Apple like an artist runs a studio – tight, focused, and full of vision.

Apple Eventually Took Buffett’s Advice

After Jobs passed in 2011, Apple’s approach shifted. Under Tim Cook, the company eventually did start repurchasing shares. In fact, Apple has since spent hundreds of billions on buybacks. The stock price soared, investors got happy, and Apple became even more valuable. On paper, it looks like Buffett’s advice was right all along.

However, Steve Jobs wasn’t trying to be right in the short term. He wasn’t building a stock portfolio. He was building Apple itself. The culture, the products, the future. His style was about going against the grain.